Case Study - A modern finance platform accelerating digital loan processes

FinBank is an innovative financial institution offering digital loan products to individual and corporate customers. Hallederiz Labs digitalized end-to-end loan application processes with a modern engineering approach, built secure integrations, and rebuilt the cloud-based architecture with a focus on performance, security, and scalability.

- Product

- FinBank

- Year

- Services

- Web Development, Integrations, Cloud Architecture

Overview

FinBank aimed to fully digitalize and accelerate its loan application processes. The traditional infrastructure was slow, and manual steps were prone to errors. Moreover, with increasing customer demand, the systems could not scale effectively, putting customer satisfaction at risk.

At Hallederiz Labs, our goal was to build faster loan applications, more secure transaction processes, and a scalable financial infrastructure. To achieve this, we developed a holistic solution that combined design, engineering, and AI-driven automation.

Our Approach

- Strategy & Roadmap: Digital lending objectives, customer journeys, and KPIs were redefined; a clear roadmap divided into short sprints was created.

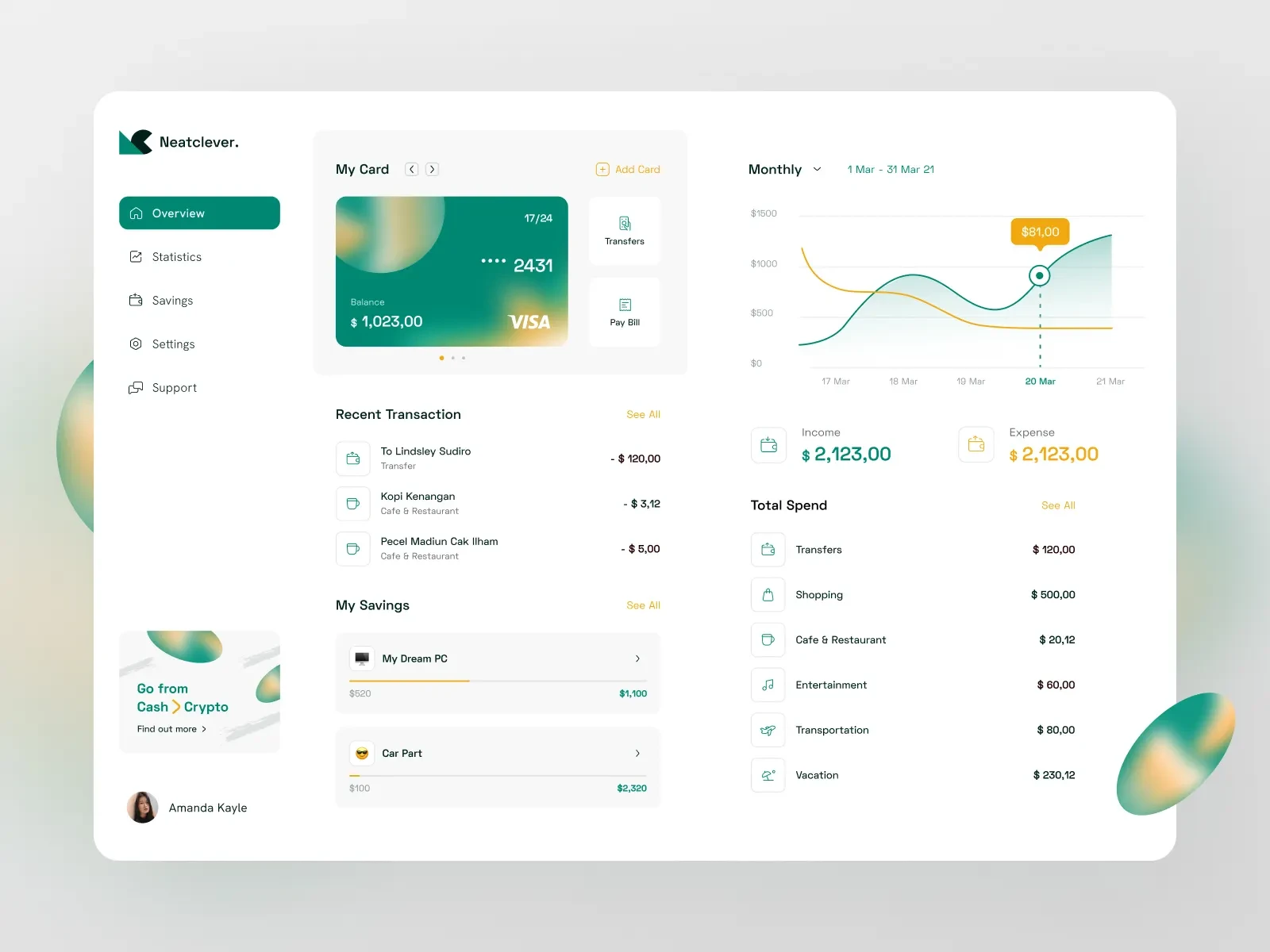

- Experience Design: Loan application screens were redesigned to improve user experience while maintaining security standards.

- Modern Engineering: API-first integrations connected CRM and core banking systems; automated testing and continuous delivery (CI/CD) pipelines were implemented.

- Cloud & Security: Multi-region deployment, auto-scaling, observability, and financial sector security standards (PCI-DSS, IAM best practices) were applied.

- Performance & Measurement: Core Web Vitals were improved; user journeys were analyzed and continuously optimized through analytics.

What We Did

- Frontend (Next.js)

- Core Banking Integration

- Cloud Architecture

- DevOps & CI/CD

- Performance Optimization

Working with Hallederiz Labs gave us not only new technology but also a new perspective. They redefined our loan processes, accelerated our customer application experience, and prepared our infrastructure for the future.

CTO, FinBank

Results

- Faster loan application process

- 3x

- Increase in customer satisfaction

- +36%

- Operational efficiency improvement

- +45%

- Availability (SLA)

- 99.99%

Technical Achievements

- Digital Loan Processes: Application steps were accelerated and manual workload was reduced.

- API-first Integrations: Core banking and CRM systems were connected through modern APIs.

- CI/CD & Automation: Secure production deployments were completed in minutes.

- Security: PCI-DSS compliance and robust identity management ensured financial sector standards.

Value Proposition

This transformation brought FinBank’s loan processes up to the speed of the digital age. Today, the platform operates with an agile, secure, and customer-centric structure powered by Hallederiz Labs.